The city of Roanoke Rapids Tuesday received its audit report for the past fiscal year — an unmodified opinion that was free of material weaknesses and noted no instances of noncompliance with state statutes.

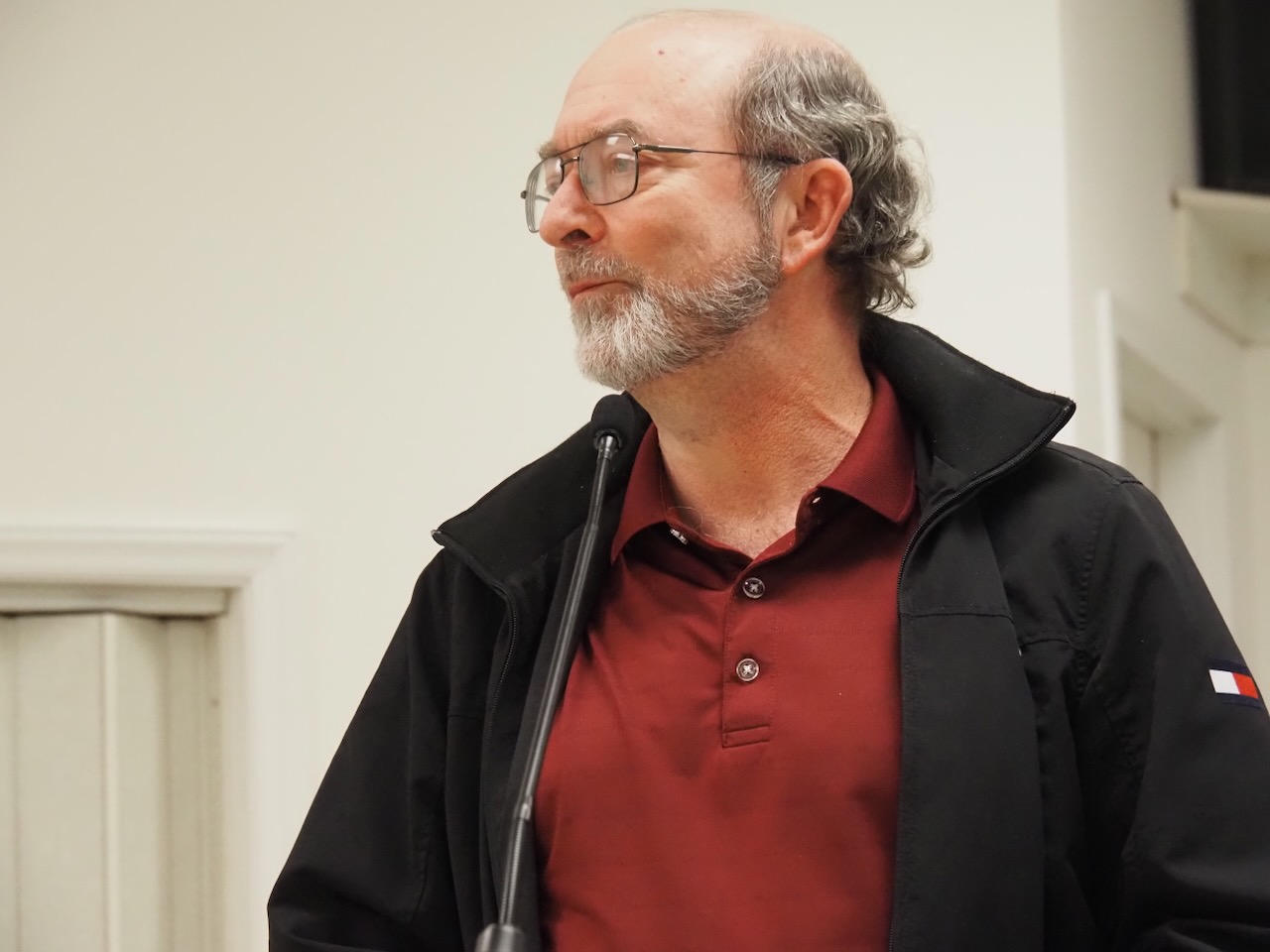

Gregory T. Redman, a Tarboro CPA , told the city council that the North Carolina Local Government Commission approved the audit last week.

The city’s unassigned fund balance was $12,233,506 at the close of the last fiscal year — June 30, 2025. “The Local Government Commission looks at that as a percentage of your annual expenditures,” Redman said.

The city’s annual expenditures were just over $19 million, he noted. “So you had a 64 percent unassigned fund balance. That’s about the statewide average. The minimum requirement is 32, but you met 64, which is a statewide average for cities your size.”

Revenues exceeded expenses by $1,310,245. “The general fund is just supposed to support itself. Anytime you have a surplus, that’s a good thing.”

Redman noted the city has whittled down the debt on the former Randy Parton Theatre — now Weldon Mills Theatre — to where $6,088,406 remains in special revenue bonds.

The city had a tax collection rate of 99.32 percent. Although the county collects the money for the city, Redman said, “That is a good collection percentage.”

Councilman Warren Keith Bell made the motion to accept the audit report, and Sandra Bryant cast the second. The audit was unanimously accepted. Bell thanked the department heads and the City Manager for the clean audit report. “It was a job well done.”

Financial Performance Highlights

The City experienced a successful year, characterized by increased revenue and controlled expenditures.

Net Position: The City’s total net position (assets exceeding liabilities) stood at $11,377,050 at year-end.

Increase in Assets: Net position increased by $2,836,396 during the fiscal year.

Fund Balance Growth: The governmental funds reported a combined ending fund balance of $14,323,238 , a net increase of $1,310,245.

Tax Collection: The City maintained a high current-year tax collection rate of 99.32 percent, which is above the statewide average of 99.

General Fund Breakdown

The General Fund is the primary operating fund for City services.

Revenues (Total: $20,493,198)

Ad Valorem Taxes: $9,932,718 (the largest revenue source).

Unrestricted Intergovernmental: $5,041,343 (includes sales tax and utility franchise tax).

Sales and Services: $2,184,985.

Expenditures (Total: $19,182,953)

Public Safety: $7,198,724 (includes Police and Fire).

General Government: $3,327,149.

Environmental Protection: $2,549,471 (includes Sanitation and Property Maintenance).

Transportation: $2,348,978.

Debt and Capital Assets

Total Debt: The City's total long-term liabilities stood at $23,586,475. This includes $6,088,406 in Special Revenue Bonds.

Capital Assets: The City holds $16,195,754 in capital assets (net of depreciation), including land, buildings, and infrastructure.

Legal Debt Margin: The City has a legal debt margin of $111,792,606, indicating it is well within its statutory borrowing limits.

Economic Outlook

The report highlights significant commercial and residential growth.

Building Valuations: The Planning & Development Department processed projects with a total building valuation of $28,653,314.

New Businesses: There were 26 Business Use Permit applications , ranging from retail and restaurants to medical offices.